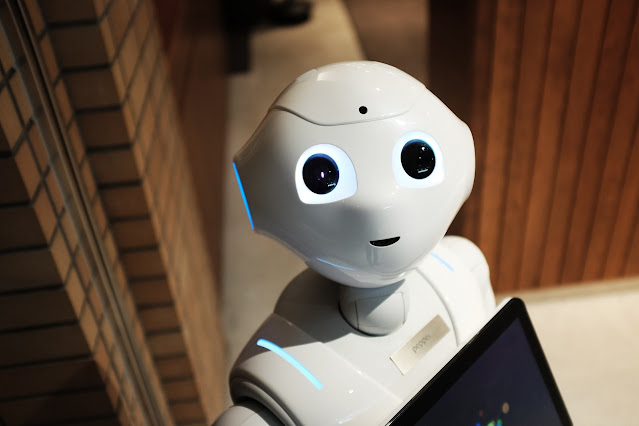

Robo-Advisors! for Your Investing Stock in 2024

In today's digital age, the world of investing has seen a significant transformation with the emergence of robo-advisors. These innovative platforms provide automated, algorithm-driven financial planning and investment services, revolutionizing the way individuals approach stock market investments.

In this article, we will explore, their benefits, limitations, and the overall future of investing.

The Evolution of Robo-Advisors

They burst onto the scene in 2008 with the introduction of Betterment and Wealthfront, two pioneering platforms in the industry. While wealth managers have been utilizing automated portfolio allocation software since the early 2000s, these platforms made investment advice accessible to a broader audience.

Betterment initially focused on rebalancing assets within target-date funds, while Wealthfront aimed to provide investment advice to the tech community. These platforms demonstrated the potential of computer software in democratizing wealth management.

How Robo-Advisors Work

Robo-advisors utilize modern portfolio theory (MPT) to automate and optimize passive indexing strategies. When users sign up, they are typically asked to complete an online survey that gathers information about their financial situation and future goals.

Based on this data, they offer personalized investment advice and automatically executes investment decisions on behalf of the user. These platforms often utilize rebalancing bands to maintain optimal asset-class weightings, ensuring the portfolio stays aligned with the user's investment goals.

Benefits of Robo-Advisors

They offer numerous advantages compared to traditional financial advisors. One of the primary benefits is their low cost. By eliminating the need for human labor, they can offer investment services at a fraction of the cost charged by traditional advisors.

Most charge annual flat fees of less than 0.4% per specific amount managed, which is significantly lower than the typical 1% charged by human advisors.

Another advantage of robo-advisors is their accessibility. These platforms have low minimum investment requirements, making them suitable for retail investors with limited capital.

Additionally, they provide convenient access to investment information through online platforms, allowing users to monitor their investments 24/7 with just an internet connection.

They are also known for their efficiency. With a few clicks, users can execute trades, manage their portfolios, and access financial advice, eliminating the need for time-consuming meetings with financial advisors.

Furthermore, often employ passive index investing strategies, which have been shown to produce favorable results for ordinary investors.

Limitations of Robo-Advisors

While robo-advisors offer significant benefits, they also have their limitations. One of the main drawbacks is the lack of human interaction. operate solely based on algorithms, lacking the empathy and personal touch that human advisors provide.

This can be a disadvantage for individuals who prefer a more personalized approach to their finances or require complex financial services such as estate planning or trust fund administration.

Furthermore, they may not be suitable for investors facing unexpected crises or extraordinary situations. These platforms are designed to operate under the assumption that users have clearly defined financial goals and a comprehensive understanding of investment concepts.

In reality, many investors lack this level of financial literacy and may benefit from the guidance of a human advisor during uncertain times.

The Growth of Robo-Advisors

Despite their limitations, have experienced explosive growth in recent years. It is projected that client assets managed by robo-advisors will reach $3 trillion by 2023 and $5 trillion worldwide by 2027. This growth is indicative of the increasing acceptance and adoption of as a viable investment option in the stock market.

Choosing the Right Robo-Advisor

When selecting a robo-advisor, it is essential to consider the features, fees, and reputation of the platform. Each robot-advisor may excel in different areas, so conducting thorough research is crucial.

Some platforms offer additional services, such as cash management or socially responsible investing options, which may be of interest to certain investors.

It is also important to understand the target demographic of each robo-advisor. While these platforms are accessible to a wide range of investors, they often target younger, technology-savvy individuals who are still accumulating their investable assets.

Understanding the target audience can help investors determine if it aligns with their needs and preferences.

Regulation and Insurance

They are subject to the same securities laws and regulations as traditional broker-dealers. They must be registered with the Securities and Exchange Commission (SEC) and are often members of the Financial Industry Regulatory Authority (FINRA). Investors should research the regulatory compliance of using tools like BrokerCheck.

It is important to note that assets managed are not insured by the Federal Deposit Insurance Corporation (FDIC). However, some, such as Wealthfront, are insured by the Securities Investor Protection Corporation (SIPC), providing a level of protection for investors in the event of the platform's insolvency.

The Future of Investing

They have disrupted the investment landscape, offering cost-effective and accessible investment services to a wide range of investors. As technology continues to advance, is likely to evolve further, incorporating more sophisticated strategies and expanding its range of services.

While they may not completely replace human financial advisors, robo-advisors will continue to play a significant role in shaping the future of investing.

In conclusion, robo-advisors for stock have revolutionized the way individuals approach investing. With their automated, algorithm-driven platforms, these innovative tools provide accessible and cost-effective investment services to a wide range of investors.

While they have their limitations, the growth and acceptance of robo-advisors indicate a promising future for automated investing in the stock market. As technology continues to advance, it will be fascinating to see how robo-advisors evolve and shape the investment landscape.